Heads of households: $19,400 for tax year 2022Īnd the agency recently announced the retirement plan contribution changes for 2022.government obligations exempt from Colorado income tax up to 20,000 in pension or annuity taxable income. Why it matters: The new brackets for 2023 mean paychecks for many Americans could see a boost, which will help consumers who are being hit hard by inflation and arent seeing raises that keep pace with price increases. Single taxpayers and married individuals filing separately: $12,950 Are the tax brackets the same if I am retired When planning for retirement, it’s important to keep in mind how much you will be taxed on your income from the nest egg you built. Tax Rate any interest or dividend income from U.S.WASHINGTON The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Married couples filing jointly: $25,900 However, your taxable income is 90,000, which means only 925 will be taxed at 24, which is 222. IRS provides tax inflation adjustments for tax year 2022.The above rates apply to taxable income, after the standard deduction (or itemized deductions) and other tax breaks have been taken. The IRS also announced that the standard deduction for 2022 was increased to the following: Your state may have different brackets, no taxes at all or a flat rate. The Certificate of Stillbirth from Michigan Department of Health and Human Services (. (But note that the rich still paid more in 2003, and everybody else paid less, than was the case in 1992.

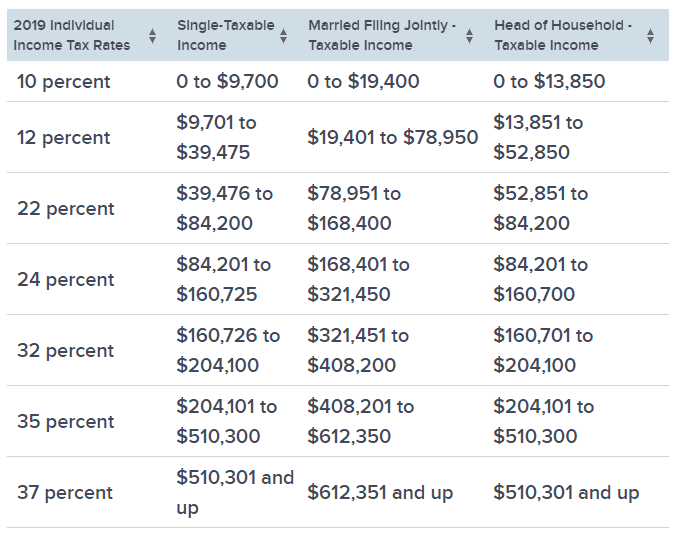

In 2003 most brackets got an additional cut of two percent with a 3.6 percent cut at the top. These are the rates and income brackets for federal taxes. The qualified disabled veterans exemption for the 2022 tax year is 400. From 2000 to 2002 most brackets dropped by one percent, and there was a new low bracket added at the very bottom. The first tax bracket, which consists of single filers who make less than 10,275 those who are married and filing jointly and make less than 20,500 and. The 2022 tax rates themselves are the same as the rates in effect for the 2021 tax year: 10, 12, 22, 24, 32, 35 and 37.

0 kommentar(er)

0 kommentar(er)